Framing The Q1 2024 Lux Capital Letter: Why do I analyze the Lux Capital letters like it’s some...

The Speed of Money: How To Measure Your Fundraising with GP Velocity™

If you’re raising your first fund or your sixth fund, you’ve probably spent months chasing meetings, tweaking decks, and wondering what “good” fundraising actually means. Everyone has advice. Almost no one shows the math.

We built GP Velocity™ to fix that.

The fundraising world has a math problem.

What GP Velocity™ is

It’s a single number that shows how fast each partner in a fund turns conversations into capital.

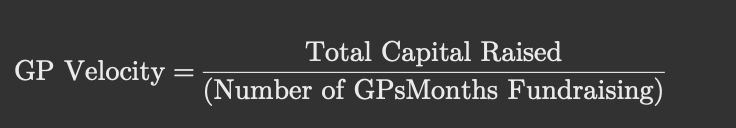

The formula is simple:

Three inputs: how much, how many, how long.

The output: how much money each GP raises per month.

It’s the fundraising version of “miles per gallon,” MPG.

And a lot of people are not gonna like it because if there is b******t, the b******t is going to become crystal-clear, very fast.

How We Define It

-

Active GP: Key Person named in the PPM with carry and fundraising responsibility.

-

Fundraising Months: From first PPM distribution to final close (include rolling closes).

-

Capital Raised: Wired or legally binding commitments only.

These definitions aren't arbitrary. They're built to remove subjectivity.

GP Velocity™ is only as accurate as the data you provide. We verify submissions, and any inconsistencies stand out instantly. Funds that can’t be transparent don’t get scored — and LPs see that.

Why 21 months matters

Across North America, data from 2023-2025 shows most PE and VC funds take 17 to 19 months to go from first close to final close.

We use 21 months as a conservative standard. It's the length of a typical fundraising “race.”

That’s the window we measure inside.

The universe we track

There are about 16 000 private-market firms across the U.S. and Canada, from seed VCs to buyout shops.

Our benchmark focuses on the top 900 actively raising funds, roughly the top five percent.

Within that group we’ve already profiled 25 funds with verified data. We sorted them into buckets.

They form the foundation of our Proprietary Cohort Benchmark (v1) for GP Velocity™, a living dataset that grows with every submission.

Your tier explained

|

Tier |

Meaning |

Typical GP Velocity™ |

|

🟩 High-Velocity GP |

Raising fast and efficiently |

≥ $1.28 M per GP per month |

|

🟨 Stable but Leaking |

Getting there, but slow |

50 – 99 % of benchmark |

|

🟥 Bleeding Efficiency |

Taking too long |

< 50 % of benchmark |

The benchmark - $1.28 million per GP per month - brepresents the top performers, the funds that raise quickly and spend more time deploying capital than chasing it.

The current benchmark, roughly $1.28 million per GP per month, represents the top quartile of funds in our dataset. Like a batting average or win–loss record, it’s a moving target: as more funds report real data, the numbers evolve. Today’s top decile is tomorrow’s league average, that’s how real benchmarks work.

How team size fits in

Not every car has the same engine, and not every fund has the same number of drivers.

We normalize expectations by team size:

|

GPs |

Fund Type |

Good Monthly Speed per GP |

|

1 – 2 |

Micro / Emerging Manager |

$0.4 – $0.8 M |

|

3 – 6 |

Core Growth / Mid-Market |

$0.8 – $1.2 M |

|

7 – 15 |

Institutional Platform |

$1.2 – $1.6 M |

|

16 + |

Mega / Global Platform |

$1.6 M + |

That way a two-person fund raising $30 M isn’t unfairly compared to a ten-person platform raising $500 M. This is why we benchmark by number of GPs and the size of the platform.

A simple example

|

Fund A |

Fund B |

|

|

Total Raised |

$100 M |

$30 M |

|

GPs |

5 |

2 |

|

Months |

18 |

24 |

|

Velocity |

$1.11 M / GP / mo |

$0.63 M / GP / mo |

|

Tier |

High-Velocity GP |

Stable but Leaking |

Fund A’s partners move almost twice as fast.

Both succeed, but one spends far less time stuck on the fundraising track.

What top performers look like

From our benchmark of 48 funds:

- Managers raise $7.1 million in 166 days.

- That’s $782 K per day in pipeline velocity.

- Average pipeline size: $95.1 million.

- Cover ratio: 25 : 1.

- Conversion rate: 7.5 %, roughly 64 % higher than the industry’s 2.5 – 6.6 % range.

That’s what efficient fundraising looks like: shorter cycles, tighter funnels, faster capital formation.

If you’re a first-time manager

Don’t worry about matching giant funds.

Start by learning your speed.

GP Velocity™ tells you if you’re fast, slow, or leaking.

It’s a mirror, not a judgment.

When you know your velocity, you know exactly what to fix.

Get your GP Velocity™ score instantly

You can now see your GP Velocity™ score the moment you submit your data.

1. Total capital raised

Include only capital that’s wired or legally committed.

If you called it today, it would clear your fund account by 5 p.m.

No soft circles. No “verbal commits.” No handshake deals. No b******t.

2. Active General Partners (GPs)

Count only Key Persons named in your PPM or those who hold carry and direct fundraising responsibility.

If an LP wouldn’t identify them as a General Partner in writing, they’re out.

3. Fundraising months

Start counting from the date your PPM or deck first went to LPs and stop at final close, rolling closes included.

Your inputs feed our Proprietary Cohort Benchmark (v1).

Within seconds, you’ll see where you sit on the spectrum from High-Velocity GP to Bleeding Efficiency. It's a diagnostic view of your operational efficiency, not a moral judgment.

GP Velocity™ helps you see what every LP already senses: how efficiently your team turns effort into capital.

Why this matters

Every month spent raising money is a month not earning carry or building companies.

Velocity isn’t a vanity metric; it’s a measure of opportunity cost.

Knowing your GP Velocity™ keeps your focus on efficiency: the one thing you can control.

The Finish Line

Stop comparing fund size.

Start comparing speed per person.

That’s the heart of GP Velocity™. It's the first benchmark that tells every manager, old or new, exactly how fast their money really moves.